Discount Allowed Double Entry

Discounts to customers may be classified into trade discount and cash discount. Ad At Your Doorstep Faster Than Ever.

The Income Statement In 2022 Accounting Basics Income Statement Accounting Student

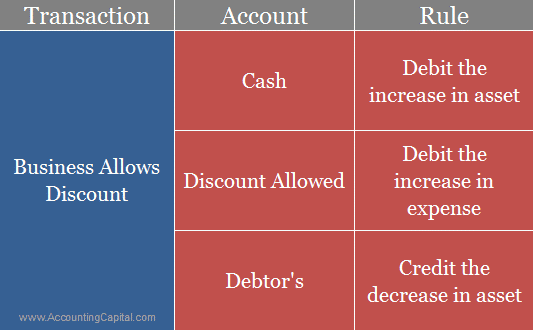

Journal Entries for Discount Allowed.

. What Is The Difference Between Discount Allowed And Discount Received. In this video you will learn how to do double entry for a discount allowed transaction and some key information to help you with other questions. Get up to 70 Off Now.

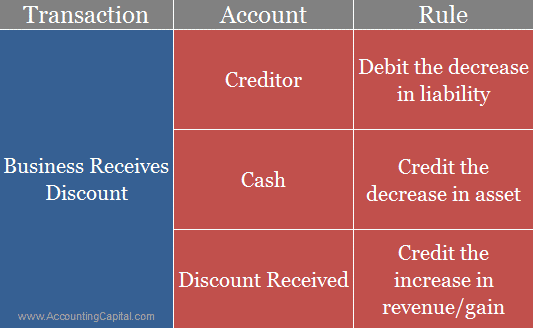

As Bike LTD qualifies for the cash discount the following double entry will be required to record the discount received. How do you enter discount allowed. This journal entry will reduce both total assets on the balance sheet and the net sales revenue on the income statement by the amount of discount allowed.

Discount Allowed and the. The discount allowed is the expense of the seller. Trade discounts are generally ignored for accounting purposes in that they are omitted from accounting.

Discount allowed can be defined as a reduction in price of goods or services which is allowed by a seller to a buyer at the expense of the seller. The discount allowed amount is posted to the Sales. The difference between discount and allowance is.

It is the discount given to customers on prompt. Subsequently discount allowed will be credited and charged to the Profit Loss. Now We will discuss the Journal Entry for Discount Allowed in the three following cases shown as below.

What is the double entry for discount received. In this case an asset accounts receivable is reduced as the balance on the account is cleared the discount allowed is treated as an expense in the income statement. Rush now and use this coupon code to get an excluive discount of 15 on your final cart value.

This discount is frequently an early payment discount on credit sales but. Discount allowed is a contra account to the sales revenue which its normal balance is on the debit side. The discount Allowed account is used to record discounts allowed on sales.

Dr Bank 7800 cheque cash Dr Discount Allowed expense 200 Cr Sale 8000 - Michael Celender. A discount is a reduction in the full price due. According to nature there are two types of discount.

Free Shipping on All Orders over 35. Exclusive Sale Instant 15 Off With Discount Allowed Double Entry Inventory Wont Last Long. A discount is a concession in the selling price of a product offered by a seller to its customers.

Accounting Double Entry for. A fixed limited amount or number that is officially allowed. How to Record Discounts Allowed in Journal Entry.

Discount allowed acts as an additional expense for the business and it is shown on the debit side of a profit and loss account. A discount allowed is when the seller of goods or services grants a payment discount to a buyer. Last modified January 17th 2020 by Michael Brown.

Sales Discount In Accounting Double Entry Bookkeeping

Credit Note For Discount Allowed Double Entry Bookkeeping

What Is The Journal Entry For Discount Allowed Accounting Capital

What Is The Journal Entry For Discount Received Accounting Capital

Amortizing Bond Discount Using The Effective Interest Rate Method Accountingcoach

Difference Between Trade Discount And Cash Discount With Example Journal Entry And Comparison Chart Key Differences

0 Response to "Discount Allowed Double Entry"

Post a Comment